Beginners’ Guide to the Stock Market

Guide to the Stock Market: A Complete Beginners’ Guide

Introduction:

For beginners, embarking on the adventure of stock market investing may be both exhilarating and overwhelming. This thorough guide tries to demystify the complexity of stock market investing by equipping new investors with the knowledge and tools they need to navigate this volatile financial world. Let’s look at the important principles and practical suggestions for individuals just getting started in the stock market, from comprehending the fundamentals to developing a strong investment strategy.

Section 1: Fundamentals of the Stock Market

1.1 What exactly is the stock market?

Begin by understanding the fundamentals of the stock market. Learn how stocks reflect a company’s ownership shares and how the stock market facilitates the buying and selling of these ownership shares.

1.2 Stock Market Power Players:

Investigate the roles of different participants, such as individual investors, institutional investors, and market makers. Understanding the interactions of these players provides vital insights on market behavior.

Section 2: How to Begin Investing in Stocks

2.1 Stock Categories:

Investigate the many forms of stocks, such as common and preferred shares. Discover how each type has its unique set of rights and hazards, allowing you to make more educated investing decisions.

2.2 How to Buy Stocks: Explain the stock-purchase procedure. This section leads you through the process of opening a brokerage account, placing orders, and exploring different order types to successfully execute transactions.

Section 3: Creating a Robust Investment Strategy

3.1 Establishing Financial Objectives:

Set specific financial objectives to drive your investment approach. Whether you’re saving for retirement, a home, or education, matching your investments to your objectives is critical for long-term success.

3.2 Understanding Risk Tolerance: design your risk tolerance to design an investment strategy that matches your level of comfort. Balancing risk and reward is an important component of building a well-rounded portfolio.

Section 4: Basic Stock Market Analysis

4.1 Fundamental Examination:

Learn the fundamentals of fundamental analysis, such as reviewing financial documents and determining a company’s health. This method assists you in making informed judgments based on the intrinsic value of a company.

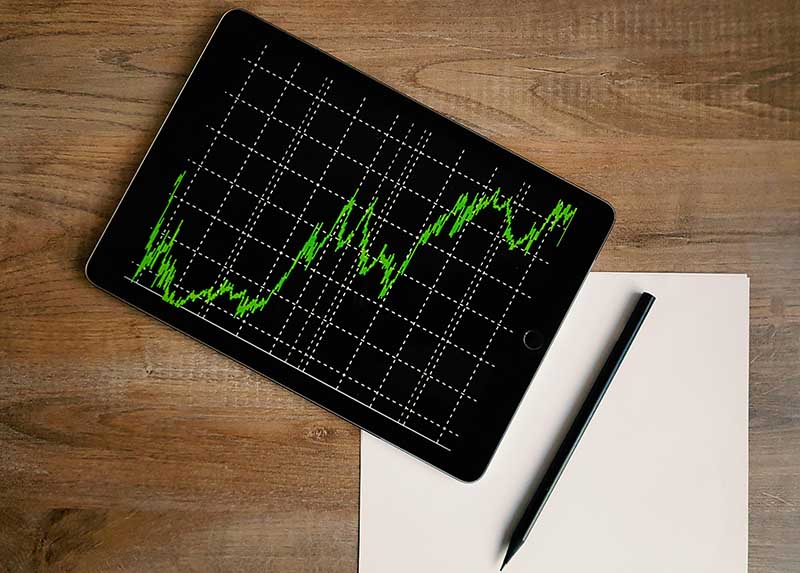

Exploration of technical analysis tools and techniques, including as chart patterns and indicators, is covered in section 4.2. Technical analysis, while not without controversy, can provide significant insights into market movements and probable entry/exit points.

Risk management and diversification are covered in Section 5.

5.1 Diversification Is Important:

Recognize the notion of diversification and its function in risk management. Creating a diverse portfolio spreads risk across multiple assets, lowering the impact of underperforming investments.

5.2 Establishing Stop-Loss Orders:

Learn how to use stop-loss orders to limit prospective losses. This risk management tool allows you to sell a stock automatically if it hits a predetermined price, so lowering negative risk.

Guide to the Stock Market. Finally, when you begin your stock market journey, keep in mind that investing is a lifelong learning process. With this guide’s information, you may approach the stock market with confidence, making informed decisions that correspond with your financial goals. Whether you’re looking for long-term wealth accumulation or short-term gains, a good understanding of stock market fundamentals is the key to investing success.